Bonus depreciation a business with a solar pv system placed in service between january 1 2008 and september 8 2010 or between january 1 2012 and december 31 2017 can elect to claim a 50 depreciation bonus.

Do solar panels qualify for bonus depreciation.

For equipment on which an investment tax credit itc grant is claimed the owner must reduce the project s depreciable basis by one half the value of the 30 itc.

See maximum depreciation deduction in chapter 5.

More importantly i don t know your whole situation but i feel like you are eligible for a form 3468 investment credit for your solar panels.

Satisfied the requirements of then applicable sec.

Depreciation on solar panels is one of the easiest ways businesses and farms looking to go solar can keep installation costs down rois high and paybacks short.

However this year you can use 100 bonus depreciation if you would like to take the full cost as depreciation expense in 2018.

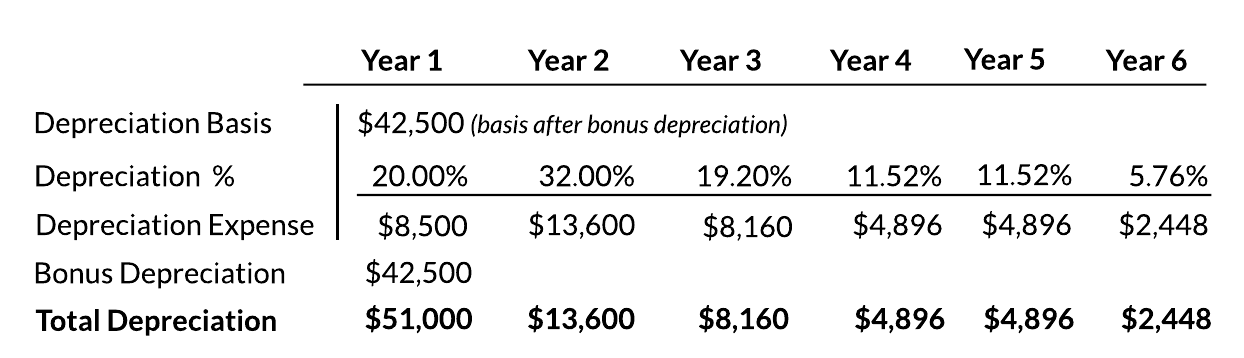

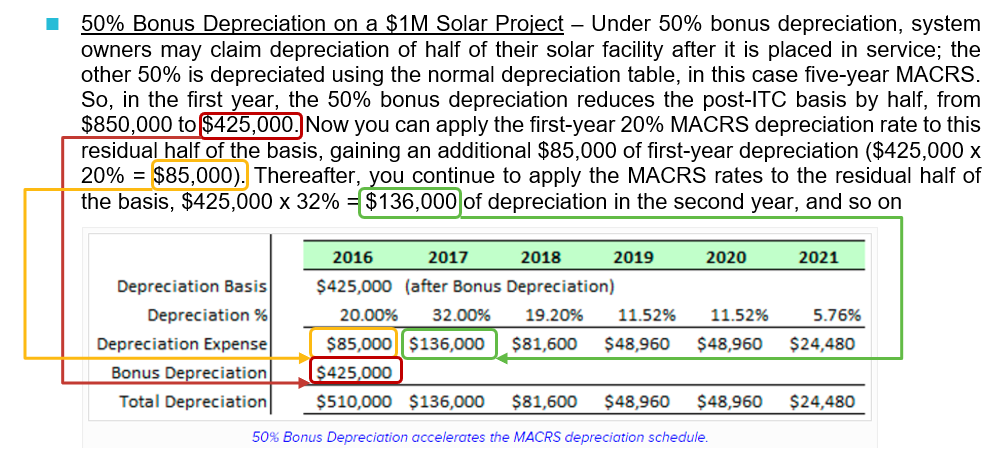

The other 50 is depreciated using the normal depreciation table in this case 5 year macrs so in the first year the 50 bonus depreciation reduces the post itc basis by half from 850 000 to 425 000.

The tax cut and jobs act of 2017 brought with it the option for 100 bonus depreciation on solar systems which is often a great way for businesses to quickly recover costs associated with integrating solar energy.

It looks like solar panels have a 5 year life.

Commercial solar arrays and macrs depreciation macrs depreciation of solar panels normally the depreciable life of solar panels is 85 of the full solar system cost which may be depreciated roughly as follows.

Because the largest percentage of most renewable energy property i e wind and solar is personal property that is otherwise 5 year modified accelerated cost recovery system macrs property and because the new law did not change the general rule for wind or solar 5 year macrs the new 100 bonus depreciation is merely an option for wind and solar deals.

46 and 48 and a special allowance for depreciation under sec.

The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2019 is 10 100 if the special depreciation allowance does not apply.

Had sufficient amounts at risk under sec.

On june 5 2018 the united states tax court ruled in favor of the petitioner taxpayer in claiming the solar energy credit under sections 46 and 48 and macrs bonus depreciation under section 168 k 5.

Qualifying solar energy equipment is eligible for a cost recovery period of five years.