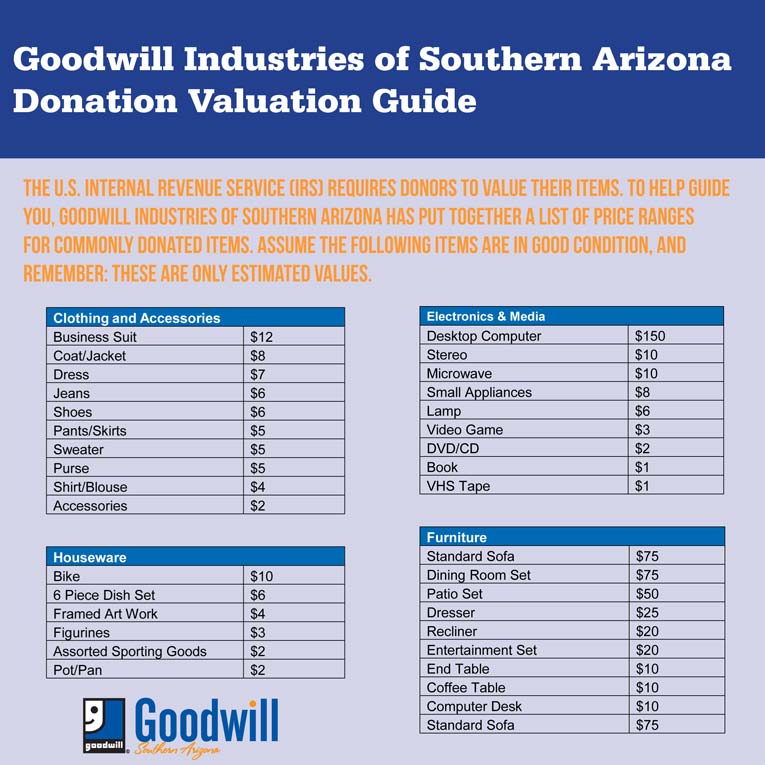

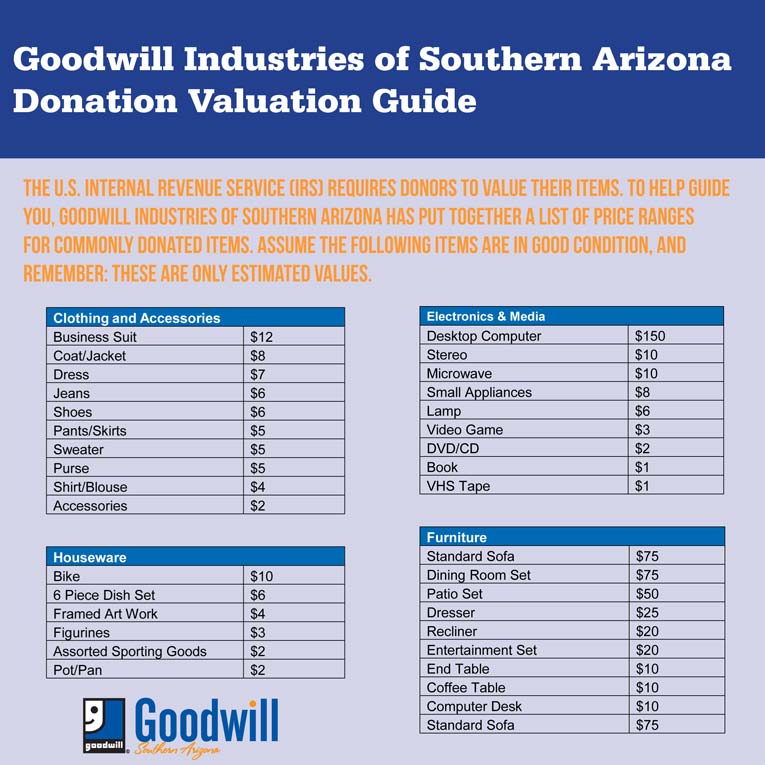

All donations of appliances electronics and equipment assumed to be working and all clothing and furniture donations in good condition.

Donation value of used appliances.

Please choose a value within this range that reflects your item s relative age and quality.

The donation value guide below helps you determine the approximate tax deductible value of some of the more commonly donated items.

Look to built in appliances for a higher asking price.

Use the donation value guide to help determine the approximate tax deductible value of items commonly donated to the salvation army.

Top values for appliances tend to vary depending on the type of appliance.

Habitat restores are home improvement stores that accept small and large donations of new or gently used furniture appliances housewares building materials and more.

Some might be worth twice as much in excellent condition while others might be valued at four or five times as much.

The fmv of the car is considered to be no more than 750.

This list is for guidance only.

Habitat restore staff and.

Staffed by a host of volunteers goodwill will also come to your home or office to pick up your appliance and deliver it to the nearest thrift store in the area.

Donation valuation guide.

The irs allows you to deduct fair market value for gently used items.

Any appliance clothes households that are donated are inspected repaired and placed for sale.

The irs requires an item to be in good condition or better to take a deduction.

A used car guide shows the dealer retail value for this type of car in poor condition is 1 600.

It includes low and high estimates.

Proceeds from the sales of these items help habitat s work in your community and around the world.

The donation valuation guide is provided by the salvation army.

These are the 2019 ranges for some of the most common.

The quality of the item when new and its age must be considered.

If you re donating appliances to charity and they re in good used condition or appraised at more than 500 you can deduct them on your federal tax return.

The irs says donated clothing and other household goods must be in good used condition or better if you claim a deduction of 500 or more for a used item that s not in good condition the.

Click here to donate to the salvation army.

Our donation value guide displays prices ranging from good to like new.

These estimations are based on the average price for the items in good condition.

Keep as much documentation as you can on their value since you can usually only deduct the appliances fair market value.

Call their toll free number at 1 800 741 0186 to schedule a pick up.